A legal change involving reverse mortgages may change the attitude of elder law attorneys.

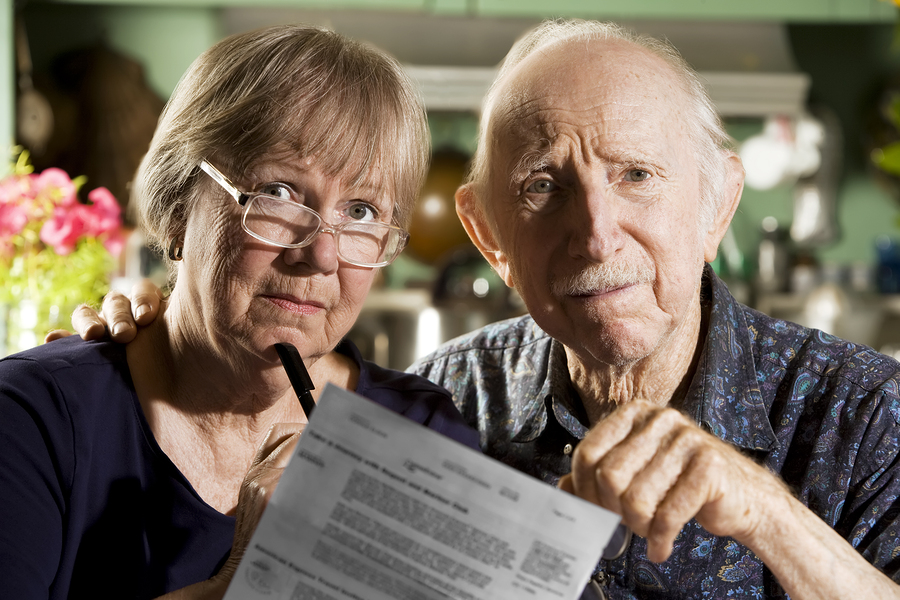

An exchange of equity in a home for an annuity known as reverse mortgages often seems like a wonderful solution to home owners as they retire and need additional funds. However, reverse mortgages are not always popular with elder law attorneys who may not see it as a simple solution.

Under the reverse mortgage, the home is sold when the retiree passes away. After the mortgage is paid off the proceeds go to the estate.

However, many elders have lost their homes when they were unable to afford all of the terms normally attending reverse mortgages for the remainder of their lives. These include paying all property taxes and insurance.

Recent legal changes could make elder law attorneys more comfortable with reverse mortgages, as reported by the Huffington Post in “New Reverse Mortgage Laws Should Positively Benefit Retirement Planning, Experts Say.”

The recent legal changes are not that complicated.

Now, part of the approval process requires that lenders make sure applicants have the ability to pay taxes, insurance and annual upkeep before approving a reverse mortgage. They also make it easier for a surviving spouse to stay in the home if their deceased spouse was the one with his or her name on the mortgage.

Taken together these changes should make elder law attorneys more comfortable with reverse mortgages and make the mortgages a better option for retired people.

It might be best to meet with an elder law attorney before entering a reverse mortgage agreement.

Reference: Huffington Post (Jan. 7, 2016) “New Reverse Mortgage Laws Should Positively Benefit Retirement Planning, Experts Say.”