Claiming to be from Social Security may give scammers a better chance of getting your assets.

Federal authorities say they have seen a number of scammers move away from claiming to be IRS agents to claiming to be from Social Security, according to The New York Times in “Latest Rash of Calls Come From ‘Social Security’“.

That doesn’t mean to say that the IRS scam isn’t still around. The IRS lists the “imposter calls” as one of its dirty dozen scams. Scam artists are flexible and quick to adapt to changing circumstances and trends.

More than 76,000 reports about fake Social Security calls were made in the twelve months ending in March, with reported losses of $19 million. That’s according to the Federal Trade Commission (FTC), which investigates consumer fraud.

By comparison, consumers reported $17 million in losses to the IRS scam during its peak time, the twelve months that ended in September 2019. This information comes from the FTC’s Consumer Sentinel Network database, a pool of millions of consumer complaints.

The typical loss to an individual consumer is about $1,500. However, those are only the people who have contacted the FTC to report their situation.

In most cases, the criminals are aggressive and try to scare their targets into action. The caller tells the person that their Social Security number has been suspended because it was involved in a crime or due to suspicious activity. The caller often asks the victim to confirm their Social Security number. They tell their victims that they must act fast and that their bank accounts will be frozen if they don’t act quickly.

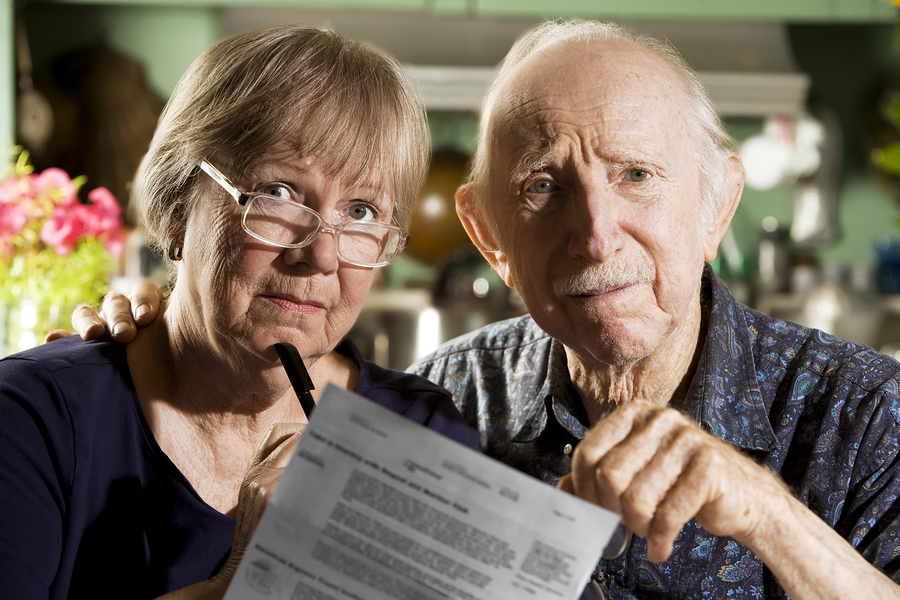

Some people, especially seniors, are scared into action. However, the calls are not real.

The Social Security Administration does not make phone calls to individuals out of the blue. Don’t reveal or confirm your Social Security number to anyone who calls.

Don’t trust the number that appears on your caller ID. Thieves use technology to make it appear that the calls are coming from a government agency, but they are not.

In April, the inspector general of Social Security warned consumers that fake calls had spoofed the agency’s own fraud hotline number. That number will never appear on a consumer’s phone, as it is never used to make outgoing calls. The best thing to do is hang up.

If you are concerned that the call might be real, call the agency directly yourself, using a phone number that you have found and not the number given to you by the scammer.

Older adults are more vulnerable to these calls, because they have access to their lifetime savings and they often exhibit behavior that puts them at risk. During a study of scam awareness, more than three fourths of seniors did not recognize the number but still took the call.

Reference: The New York Times (May 3, 2019) “Latest Rash of Calls Come From ‘Social Security’”

For more information on elder law and estate planning, please visit my estate planning website.